The Paycheck Protection Program (PPP) was introduced to assist small businesses during the economic turmoil caused by the COVID-19 pandemic. However, as with any program that involves significant financial resources, it has drawn scrutiny and raised questions regarding its integrity and the potential for misuse. One of the pressing inquiries surrounding the PPP is whether there exists a PPP loan warrant list, which could identify individuals or businesses that have defrauded the system. Understanding this topic is crucial for business owners, applicants, and the general public alike, as it sheds light on the accountability mechanisms in place for public funds.

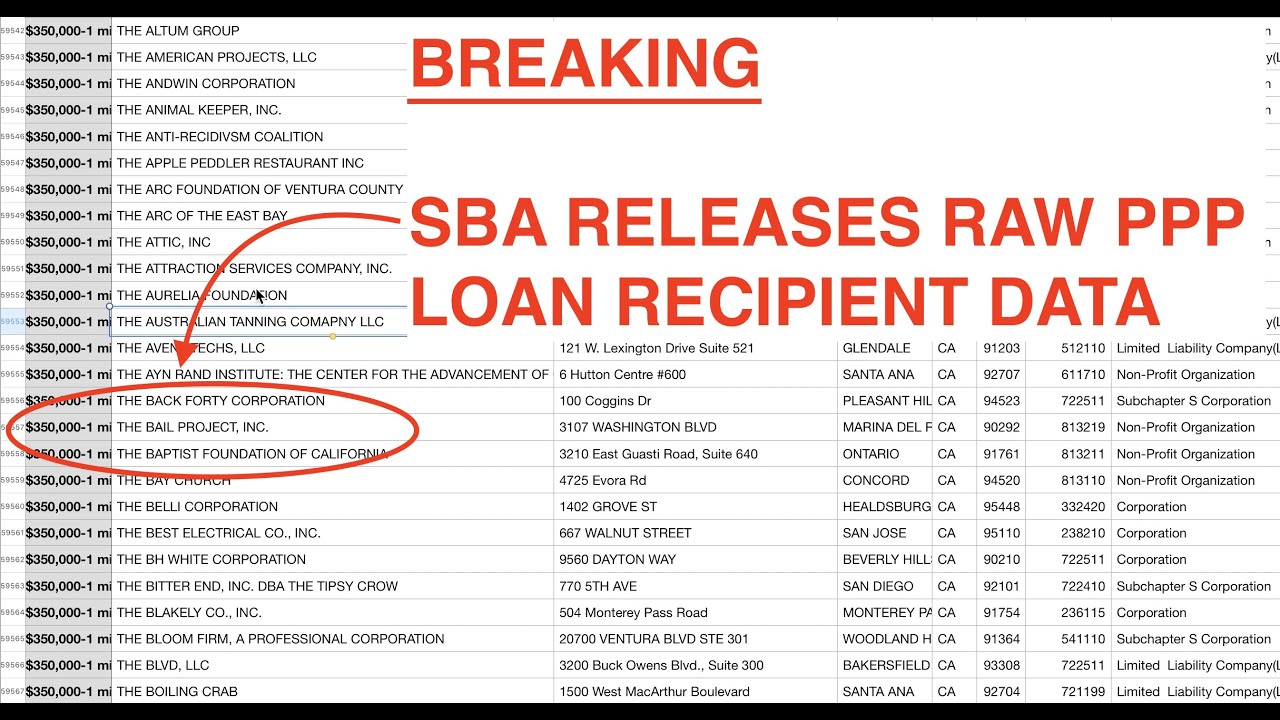

As the PPP loan program rolled out, many businesses were eager to secure funding to sustain their operations. Unfortunately, the urgency of the program led some individuals to exploit it for personal gain, leading to fraudulent applications and misuse of funds. This has raised concerns within the government and among the public about the need for transparency and oversight. Thus, the question arises: Is there a mechanism to track these fraudulent activities, and specifically, is there a PPP loan warrant list that the public can access?

In this article, we will delve into the concept of a PPP loan warrant list, exploring its existence, its implications, and how it affects both borrowers and the broader economic landscape. By answering key questions related to this topic, we aim to provide clarity on the accountability measures surrounding the Paycheck Protection Program and the potential consequences for those who attempted to defraud the system.

What Is the Paycheck Protection Program?

The Paycheck Protection Program (PPP) was enacted as part of the Coronavirus Aid, Relief, and Economic Security (CARES) Act in March 2020. It aimed to provide forgivable loans to small businesses to help them retain their workforce during the pandemic. The loans were intended to cover payroll costs, rent, mortgage interest, and utilities, offering a lifeline to businesses struggling to stay afloat.

How Was the PPP Funded?

The PPP was initially allocated approximately $349 billion, with subsequent rounds of funding increasing this amount significantly. The loans could be forgiven if businesses met certain criteria, making it an attractive option for many. However, the rapid rollout and high demand raised concerns about potential fraud.

Is There a PPP Loan Warrant List?

The existence of a PPP loan warrant list is a subject of great interest. While there is no centralized public database specifically labeled as a "PPP loan warrant list," there are mechanisms in place to track and investigate fraudulent activities related to the program. Federal agencies, including the Small Business Administration (SBA) and the Department of Justice (DOJ), have been actively investigating cases of PPP fraud.

How Are PPP Loan Fraud Cases Investigated?

Fraudulent PPP loan applications are taken seriously, and investigations involve various steps, including:

- Reviewing loan applications for discrepancies.

- Coordinating with financial institutions that disbursed the loans.

- Conducting interviews and gathering evidence.

- Prosecuting individuals found guilty of fraud.

What Are the Consequences of PPP Loan Fraud?

Individuals who engage in PPP loan fraud face severe legal repercussions. The consequences may include:

- Criminal charges, leading to potential imprisonment.

- Financial penalties, including the requirement to repay the fraudulently obtained loans.

- Damage to personal and business reputations.

Are There Public Records Related to PPP Loan Fraud?

While a specific warrant list may not exist, the DOJ has made public some of the cases it has pursued related to PPP fraud. These records can provide insight into the types of cases being investigated and the individuals involved. Accessing local court records may also reveal additional information about legal actions taken against suspected fraudsters.

What Should You Do If You Suspect PPP Loan Fraud?

If you suspect that someone has committed fraud related to the PPP, it is essential to report your concerns to the proper authorities. This may include:

- Contacting the SBA Office of Inspector General.

- Reporting the issue to your local law enforcement agency.

- Filing a complaint through the DOJ.

Can You Protect Yourself Against PPP Loan Fraud?

Business owners applying for PPP loans should take steps to ensure their applications are accurate and legitimate. Key practices include:

- Keeping detailed records of payroll and other expenses.

- Engaging with reputable financial institutions.

- Staying informed about the application process and requirements.

Conclusion: Navigating the Landscape of PPP Loan Fraud

In conclusion, while there may not be a formalized "PPP loan warrant list," the investigation into PPP fraud is ongoing and critical to maintaining the integrity of the program. As businesses continue to navigate the economic landscape post-pandemic, it is essential for applicants to adhere to ethical practices and for authorities to enforce accountability. Understanding the implications of PPP loan fraud and the investigative processes in place can help protect businesses and taxpayers alike.

Unraveling The Life Of Joyce DeWitt: Her Children And Family Insights

Unveiling The Life Of Josephine Archer Cameron

Cory Booker’s Wife: The Woman Behind The Senator